ÖÐÎÄ°æEnglish

Home > Products > Aluminum

Aluminum Futures Contract

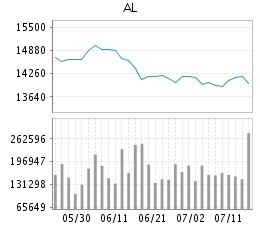

AL Price Chart

-

Contract InformationTrading Day:2018-07-17Update:2018-07-17 01:25:29[more]

Code Listing Date Expiration Date First Delivery Day Last Delivery Day Benchmark Price al1808 20170816 20180815 20180816 20180822 16265 al1809 20170918 20180917 20180918 20180925 16680 al1810 20171017 20181015 20181016 20181022 16930 al1811 20171116 20181115 20181116 20181122 16210 al1812 20171218 20181217 20181218 20181224 15180 al1901 20180116 20190115 20190116 20190122 15775 al1902 20180212 20190215 20190218 20190222 14910 al1903 20180316 20190315 20190318 20190322 14660 al1904 20180417 20190415 20190416 20190422 15215 al1905 20180516 20190515 20190516 20190522 15275 al1906 20180619 20190617 20190618 20190624 15110 al1907 20180717 20190715 20190716 20190722 14640 -

Trading ParameterTrading Day:2018-07-17Update:2018-07-17 01:25:16[more]

Code Margin Rate Limit Up(%) Limit Down(%) Long Speculation(%) Short Speculation(%) Long Hedging(%) Short Hedging(%) al1808 10 10 10 10 5 5 al1809 8 8 8 8 5 5 al1810 7 7 7 7 5 5 al1811 7 7 7 7 5 5 al1812 7 7 7 7 5 5 al1901 7 7 7 7 5 5 al1902 7 7 7 7 5 5 al1903 7 7 7 7 5 5 al1904 7 7 7 7 5 5 al1905 7 7 7 7 5 5 al1906 7 7 7 7 5 5 al1907 7 7 7 7 10 10 -

Settlement ParameterTrading Day:2018-07-17Update:2018-07-17 01:27:30[more]

Note£º

1.The transaction fee for closing out the position opened on the same day=the haircut rate for closing out the position opened on the same day * transaction fee, which is waived then the value is zero.

2.Transaction fee for aluminum futures shall refer to the amount of transaction fee.Code Settle Trans

Fee

(¡ë)Trans

Fee

Amount

(RMB

/lot)Delivery

Fee

(RMB

/ton)Margin Rate Discount Rate for Closing-out Today¡¯s Position (%) Long

Speculation

(%)Short

Speculation

(%)Long

Hedging

(%)Short

Hedging

(%)al1807 0.000 3 2 20 20 20 20 0 al1808 0.000 3 2 10 10 10 10 0 al1809 0.000 3 2 8 8 8 8 0 al1810 0.000 3 2 7 7 7 7 0 al1811 0.000 3 2 7 7 7 7 0 al1812 0.000 3 2 7 7 7 7 0 al1901 0.000 3 2 7 7 7 7 0 al1902 0.000 3 2 7 7 7 7 0 al1903 0.000 3 2 7 7 7 7 0 al1904 0.000 3 2 7 7 7 7 0 al1905 0.000 3 2 7 7 7 7 0 al1906 0.000 3 2 7 7 7 7 0 -

Delivery Parameter Trading Day:2018-07-17Update:2018-07-17 01:26:21[more]

Contract Code Delivery and Settlement Price Delivery Margin Rate

(%)Physical Delivery Unit Price(RMB/ton) First Delivery Day Last Delivery Day Tax-paid Bonded al1807 13865 11945 20 2 20180717 20180723 al1808 20 2 20180816 20180822 al1809 20 2 20180918 20180925 al1810 20 2 20181016 20181022 al1811 20 2 20181116 20181122 al1812 20 2 20181218 20181224 al1901 20 2 20190116 20190122 al1902 20 2 20190218 20190222 al1903 20 2 20190318 20190322 al1904 20 2 20190416 20190422 al1905 20 2 20190516 20190522 al1906 20 2 20190618 20190624 al1907 20 2 20190716 20190722 -

Monthly Information Update:2018-07-17 01:25:01

Contract Code Trading Month Trading Day Trading Margin Rate (%) Fee Percentage (¡ë) Unit Price of Trans.Fee(RMB/lot) al1807 201807 20180629 15.00 0.000 3 al1807 201807 20180711 20.00 0.000 3 al1808 201807 20180629 10.00 0.000 3 al1808 201807 20180711 10.00 0.000 3 al1808 201807 20180717 10.00 0.000 3 al1809 201807 20180629 7.00 0.000 3 al1809 201807 20180711 7.00 0.000 3 al1809 201807 20180717 7.00 0.000 3 al1810 201807 20180629 7.00 0.000 3 al1810 201807 20180711 7.00 0.000 3 al1810 201807 20180717 7.00 0.000 3 al1811 201807 20180629 7.00 0.000 3 al1811 201807 20180711 7.00 0.000 3 al1811 201807 20180717 7.00 0.000 3 al1812 201807 20180629 7.00 0.000 3 al1812 201807 20180711 7.00 0.000 3 al1812 201807 20180717 7.00 0.000 3 al1901 201807 20180629 7.00 0.000 3 al1901 201807 20180711 7.00 0.000 3 al1901 201807 20180717 7.00 0.000 3 al1902 201807 20180629 7.00 0.000 3 al1902 201807 20180711 7.00 0.000 3 al1902 201807 20180717 7.00 0.000 3 al1903 201807 20180629 7.00 0.000 3 al1903 201807 20180711 7.00 0.000 3 al1903 201807 20180717 7.00 0.000 3 al1904 201807 20180629 7.00 0.000 3 al1904 201807 20180711 7.00 0.000 3 al1904 201807 20180717 7.00 0.000 3 al1905 201807 20180629 7.00 0.000 3 al1905 201807 20180711 7.00 0.000 3 al1905 201807 20180717 7.00 0.000 3 al1906 201807 20180629 7.00 0.000 3 al1906 201807 20180711 7.00 0.000 3 al1906 201807 20180717 7.00 0.000 3 al1907 201807 20180717 7.00 0.000 3

Market Data and Charts are delayed at least 30 minutes.

| Contract | Last | Chg | Open Interest | Volume | Bid-Ask | Pre-clear | Open | Comment |

| Contract | Weighted Average Price 9:00-10:15 |

Change over Previous Trading Day | Weighted Average Price 9:00-15:00 |

Change over Previous Trading Day |